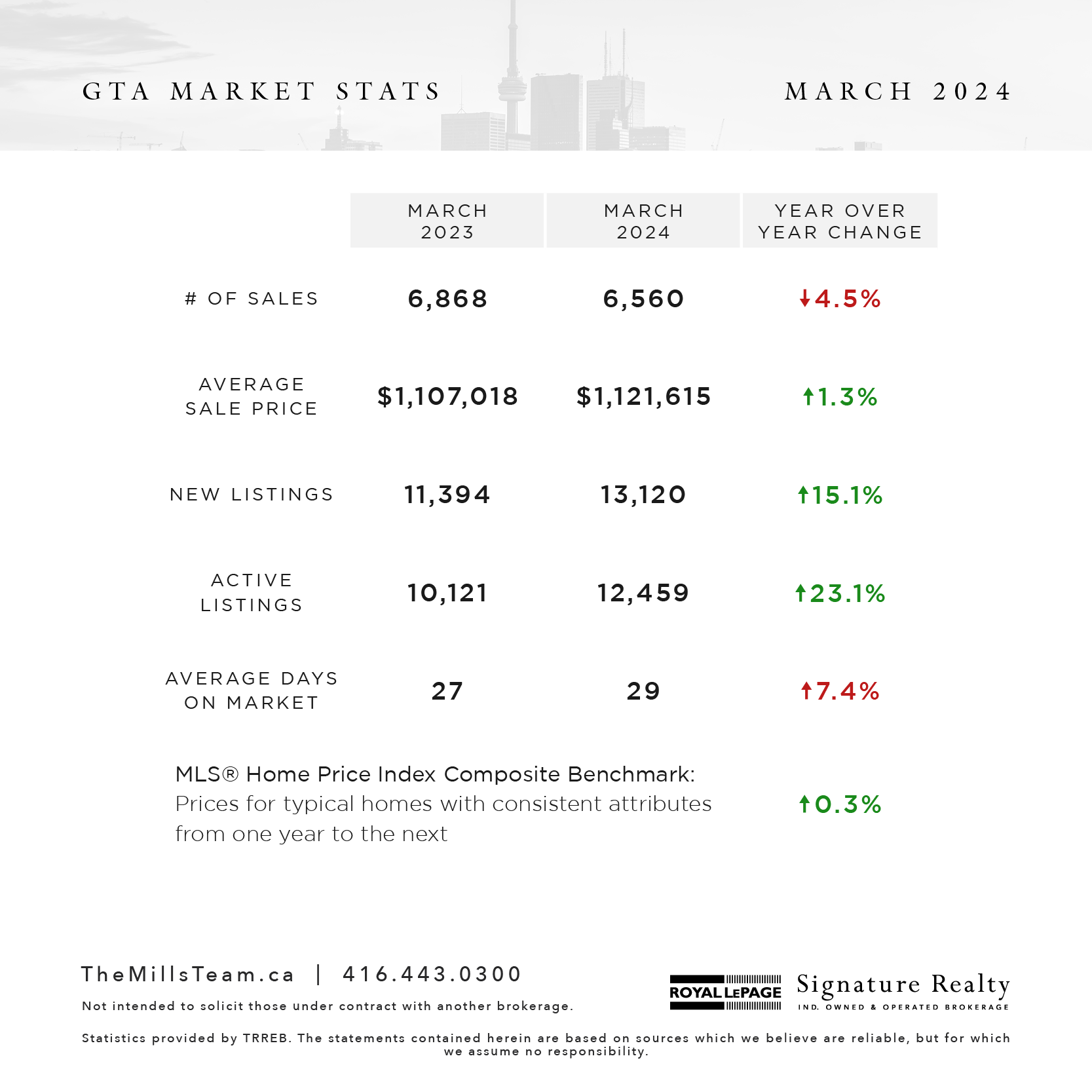

TORONTO, ONTARIO, April 3, 2024 – March 2024 home sales reported through TRREB’s MLS® System were lower

than the March 2023 result, due in part to the statutory holiday Good Friday falling in March this year versus April last

year. Despite a better-supplied market compared to last year, there was enough competition between buyers to see a

moderate increase in the average March home price compared to last year’s level.

Greater Toronto Area (GTA) REALTORS® reported 6,560 sales through TRREB’s MLS® System in March 2024 – down

by 4.5 per cent compared to March 2023. New listings were up by 15 per cent over the same period. On a seasonally

adjusted monthly basis, sales were down by 1.1 per cent. New listings were down by three per cent compared to

February.

The first quarter ended with sales up by 11.2 per cent year-over-year. New listings were up by a greater annual rate of

18.3 per cent.

“We have seen a gradual improvement in market conditions over the past quarter. More buyers have adjusted to the

higher interest rate environment. At the same time, homeowners may be anticipating an improvement in market

conditions in the spring, which helps explain the marked increase in new listings so far this year. Assuming we benefit

from lower borrowing costs in the near future, sales will increase further, new listings will be absorbed, and tighter market

conditions will push selling prices higher,” said TRREB President Jennifer Pearce.

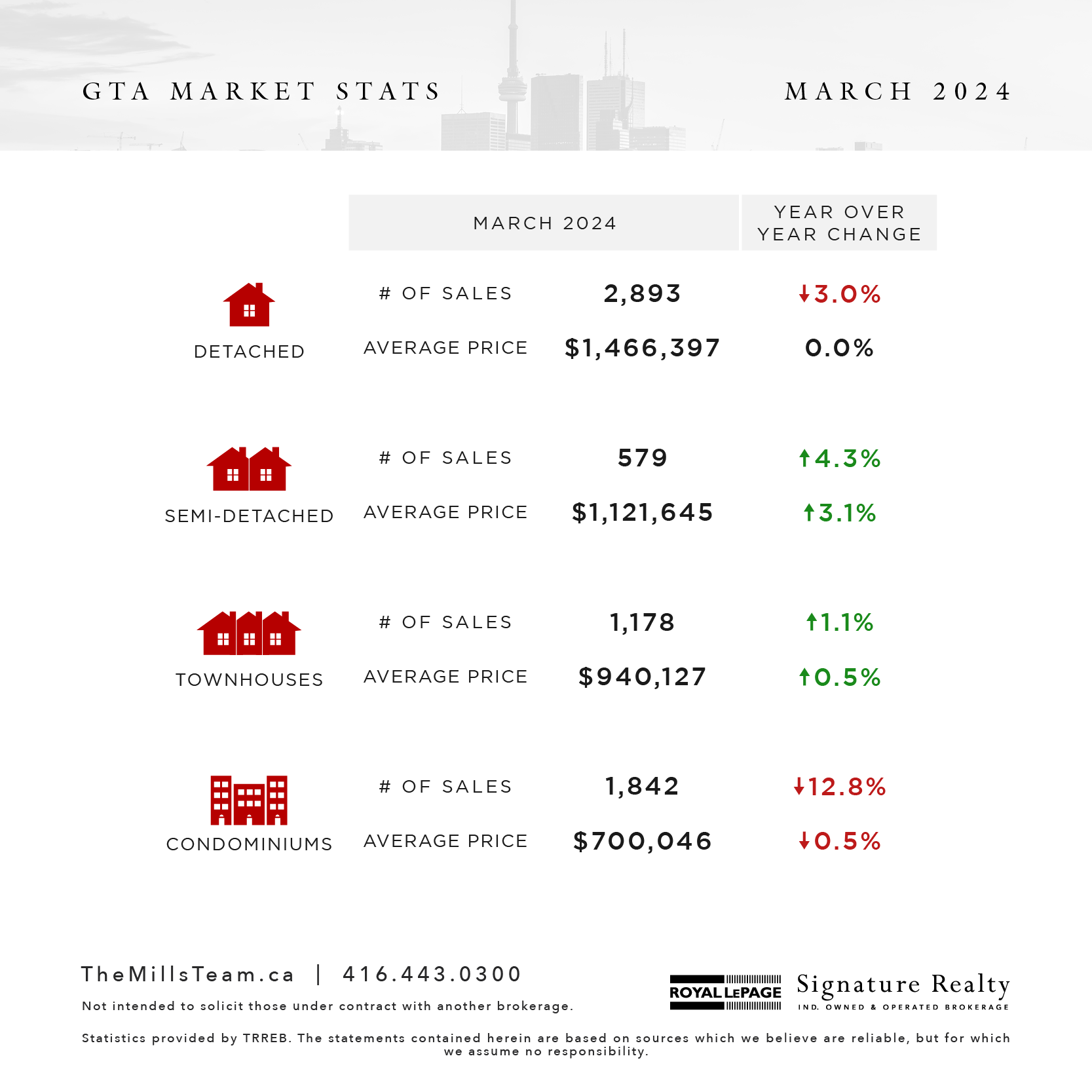

The MLS® Home Price Index (HPI) Composite benchmark was up by 0.3 per cent year-over-year. The average selling

price was up by 1.3 per cent to $1,121,615. On a seasonally-adjusted month-over-month basis, the MLS® HPI

Composite was up by 0.2 per cent and the average selling price was up by 0.7 per cent compared to February.

“The average selling price edged up in comparison to last year as we moved through the first quarter of 2024. Price

growth is expected to accelerate during the spring and even more so in the second half of the year, as sales growth

catches up with listings growth and sellers’ market conditions start to emerge in many neighbourhoods. Lower borrowing

costs in the months ahead will help fuel increased demand for ownership housing,” said TRREB Chief Market Analyst

Jason Mercer.

“As demand for ownership and rental housing increases, supply will continue to be top of mind. Governments at all levels

must maintain their focus on pursuing innovative solutions to increase the amount and mix of housing supply to improve

affordability. This includes removing roadblocks to non-traditional arrangements, such as co-ownership models to benefit

home buyers, including first-time buyers and seniors. Encouraging gentle density, including multiplexes, is critical to

helping high demand areas such as the Greater Golden Horseshoe to meet housing supply targets,” said TRREB CEO

John DiMichele.